From Legacy to Licensed Cannabis

Introduction

Almost invariably, markets – that is, the voluntary exchange of goods and services between buyers and sellers – will emerge whenever sellers can profitably meet the wants and needs of buyers. Governments can impede the emergence of markets by making exchanges of certain products or services illegal. However, when the wants or needs are strong enough to create sufficiently high profit opportunities, then, regardless of legal status, markets will emerge.

So go the markets for cannabis.

During the late 1960s – early 1970s, the US government all but blocked flows of cannabis into the US from foreign sources. Despite the illegal status of cannabis in the US, demand was strong enough to induce the emergence of a whole new industry of home-grown supply: legacy cannabis.[1] For over 50 years – half a century – robust markets in cannabis have existed throughout the US, again, despite its illegal status. For over 50 years, suppliers have been improving the quality of home-grown cannabis to the point that US-grown cannabis is generally considered world-class.[2]

Starting about 25 years ago, governments started legalizing cannabis in select US markets (California was the first, legalizing medical cannabis in 1996). In those select locales, legal markets have emerged alongside longstanding legacy markets.

Of course, federal and state governments have been trying to extinguish legacy markets since their inception. More recently, state governments in newly established legal markets had hoped that the legal markets would subsume legacy markets. That is, governments had hoped that legacy providers would either transition to legal markets, for example, through cannabis social justice programs, or be driven out of existence by legal market operations.[3] This has not happened. In fact, the inability of governments to create legal environments amenable to participation by legacy market suppliers has generally increased legacy market participants’ disdain toward government.[4] Likewise, the refusal of legacy market participants to either transition to legal markets or simply fade away has further antagonized government.

June 2021 marked the 50th anniversary of the US government’s war on drugs. Since its inception, government has spent over a trillion dollars fighting this war. By many measures, it’s been an utter failure – imprisoning millions, many unjustly, while failing to decrease drug usage or prevent drug-related deaths.[5]

The failure of the war on drugs has established that enforcing laws against unlicensed and/or illegal drug activity simply doesn’t work. The only way to drive out such activity is to legalize it, or otherwise make it uneconomic and/or undesirable in which to participate.

Licensed Cannabis Markets: The Current Landscape

Adult use cannabis has been legal for at least five years (long enough to have matured a bit) in nine states. Over the past two years, these more mature markets have experienced large supply gluts, which have led market prices to collapse.[8] This price compression is causing many companies – particularly the smaller, less-well-funded businesses – to struggle financially, driving industry consolidation, as better-funded companies absorb those that are no longer viable.[9] Many of the few legacy businesses that were able to initially transition to licensed markets are now facing bankruptcy.[10]

In the meantime, states that have recently legalized adult use markets, including New York, are focusing even more on implementing social justice programs. These programs are geared toward enabling those in legacy markets and others who have been harmed in the past by the war on drugs to enter licensed markets.[11] Many legacy participants have been eager to participate in licensed markets from the beginning. The failure of many earlier legal markets to create environments amenable to inclusion of legacy actors has increased the urgency of regulators in newer markets to make more concerted efforts to accommodate legacy participation.[12]

Legacy Cannabis Markets

Legacy market participants are those people who have been active in the cannabis industry since before it was legal and whose activities have paved the way for cannabis legalization.[13]

Legacy growers tend to “have a strong relationship with cannabis as an agent of healing and hope.”[14] They are renowned for their craft cannabis products whose genetics and cultivation methods have been carefully nurtured over time to yield quintessential buds rich in cannabinoids and terpenes. Legacy growers generally work on small farms and perform all tasks manually, in other words, it’s about quality, not quantity.[15]

Legacy users are people for whom cannabis is a way of life.

The culture has a lot to do with respect. Respect for the plant, farmers, distributors, planet, environmental protections, human rights, freedom, and standing up to the toxic corporate capitalism and crony political nonsense that arrested, killed, and destroyed thousands if not millions of lives in the name of a “drug war.”[16]

Legacy users enjoy “seshing with friends,” that is, enjoying cannabis as part of a larger social experience to be shared with others. As with most community-minded cultures, legacy users value and support the cannabis community, in particular by supporting legacy growers.

As previously indicated, as newly licensed cannabis markets have emerged, many legacy market participants have expressed a desire to transition away from unlicensed activity and toward licensed markets. Unfortunately, high license fees and taxes, together with regulations that favor large businesses over smaller operations, have created barriers to entry that most legacy operators have been unable to overcome.[17]

To gain some perspective, in a February 2018 report, the California Growers Association noted:

More than sixty thousand [60,000] cannabis farmers currently operate around the state. We estimate that these farms employ 3.6 people on average, for a whopping 258,000 jobs.[18]

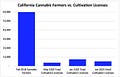

As of June 2018, California had issued 3,844 licenses to cultivators.[19] As of January 2023, California had issued 7,651 active licenses to cultivators, of which 5,366 were for small cultivation operations.[20] In other words, less than ten percent of the cannabis farmers in 2018 were licensed to grow cannabis in the state as of the beginning of 2023.

Of course, the problem here is that if the licensed markets cannot accommodate them, many small farmers, especially those that have been around for decades, will simply fall back into unlicensed activity. Unlicensed markets have continued to thrive alongside licensed activity, since unlicensed cannabis is so much cheaper than the heavily-taxed, licensed market products,[21] and since premium legacy cannabis is always in demand, whether growers are supplying licensed or legacy markets.

Envisioning Inclusive Cannabis Markets

Perhaps the largest hurdles currently preventing legacy participants from transitioning to licensed markets are:

Legacy Market Amnesty:[22] Legacy providers with past cannabis convictions want to participate in licensed markets.

Funding Problems: Legacy (and other small) providers have trouble financing operations, due to:

Restrictions on direct-to-consumer sales channels:[26] Current regulations require cultivators and brands to sell their products through dispensaries. Product oversupply generally and also with respect to dispensaries, are creating shortages in shelf space, which tend to favor larger suppliers. Legacy (and other small) suppliers, for whom dispensary shelf space is scarce, want to be able to connect directly with consumers.

As we see, the problems currently preventing legacy (and other small) providers from participating in licensed cannabis markets are generally regulatory in nature. In other words, it’s up to governments to decide whether:

To ease current regulations enabling more inclusive markets, which will naturally minimize unlicensed activity, or

To maintain current regulations, which will foster rich markets in unlicensed activity.

Given the nature of state cannabis programs enacted thus far, I don’t have much faith that governments will choose the more inclusive path.

[1] https://www.nytimes.com/1995/02/19/magazine/how-pot-has-grown.html

[2] https://herb.co/learn/best-weed-world-netherlands-canada-unitedstates/

[3] https://www.bridgemi.com/michigan-government/legal-marijuana-didnt-end-black-market-elsewhere-what-can-michigan-learn

[4] https://www.politico.com/news/2021/10/23/california-legal-illicit-weed-market-516868

[5] https://www.cnbc.com/2021/06/17/the-us-has-spent-over-a-trillion-dollars-fighting-war-on-drugs.html

[6] https://thecannabisindustry.org/ncia-news-resources/state-by-state-policies/

[7] https://quantaa.com/blog/558-how-regulations-shape-the-cannabis-industry

[8] https://quantaa.com/blog/575-anatomy-of-a-cannabis-price-crash

[9] https://blog.rootwurks.com/rootwurks/low-prices-consolidation-and-new-markets-what-will-2023-mean-for-cannabis

[10] https://www.cannabisbusinesstimes.com/news/california-cannabis-peril-dream-nightmare-legalization/

[11] https://www.healthline.com/health/social-equity-in-cannabis#Black-owned-brands-doing-the-work, https://www.forbes.com/sites/roberthoban/2020/08/31/the-critical-importance-of-social-equity-in-the-cannabis-industry/?sh=209448561a6d

[12] https://www.brookings.edu/blog/fixgov/2021/04/16/state-cannabis-reform-is-putting-social-justice-front-and-center/

[13] https://njbiz.com/building-a-bridge-from-legacy-to-legal-cannabis-market/, https://cannabis101.de/legacy-cannabis-and-its-impact-on-the-legalizing-industry/, https://cannadelics.com/2022/01/14/legacy-cannabis-operators-shunned-from-billion-dollar-industry/, https://beardbrospharms.com/2021/10/26/legacy-cannabis-professionals/

[14] https://www.forbes.com/sites/andrewdeangelo/2023/02/15/5-great-reasons-to-buy-legacy-and-social-equity-weed-brands/?sh=5359f1102e45

[15] https://www.cannaconnection.com/blog/19317-craft-cannabis-what-you-need-to-know

[16] https://beardbrospharms.com/2021/10/26/legacy-cannabis-professionals/

[17] https://spectrumlocalnews.com/nys/central-ny/news/2022/07/21/inside-new-york-s-legacy-cannabis-market-s-work-to-become-legal,https://www.timesunion.com/news/article/Legacy-cannabis-operators-want-in-to-formal-17194735.php,https://cannadelics.com/2022/01/14/legacy-cannabis-operators-shunned-from-billion-dollar-industry, An Emerging Crisis: Barriers to Entry in California Cannabis. (2018, Feb 19). California Growers Association. https://www.cannabisbusinesstimes.com/news/california-cannabis-peril-dream-nightmare-legalization/, https://njbiz.com/building-a-bridge-from-legacy-to-legal-cannabis-market/

[18] An Emerging Crisis: Barriers to Entry in California Cannabis. (2018, Feb 19). California Growers Association.

[19] https://www.newcannabisventures.com/california-adds-6421-cannabis-licenses-in-first-half-of-2018/

[20] https://aca6.accela.com/calcannabis/Welcome.aspx

[21] https://www.pacbiztimes.com/2022/09/15/six-years-after-legalization-cannabis-black-market-still-thriving/

[22] https://njbiz.com/building-a-bridge-from-legacy-to-legal-cannabis-market/

[23] https://njbiz.com/building-a-bridge-from-legacy-to-legal-cannabis-market/

[24] https://cannabis101.de/legacy-cannabis-and-its-impact-on-the-legalizing-industry/

[25] https://www.leafly.com/news/industry/finding-the-green-zone-how-specialty-realtors-are-cashing-in-on-cannabis, https://www.fox5ny.com/news/nj-cannabis-licensees-high-rent-costs

[26] https://www.cannabisbusinesstimes.com/news/california-cannabis-peril-dream-nightmare-legalization/, https://www.greenmarketreport.com/longshot-bill-for-cannabis-direct-to-consumer-shipping/